delayed draw term loan commitment fee

The full value of the loan is used up. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

The loans come with a host of fees and some restrictions.

. In syndicated term loan financings ticking fees have often been priced at half the margin within some. The commitment fee is typically lower than the interest rate that is charged on the drawn portion of the. In term loans that have delayed draw mechanics the commitment fee typically referred to in this context as a ticking fee is payable on the unfunded commitments.

See FG 3413 for discussion of debt modification or exchange on delayed draw term loans. The Delayed Draw Term Commitment Ticking Fees shall accrue at all times from and including the Closing Date until but excluding the earlier of the Delayed Draw Term Loan Date and the date on which the Delayed Draw Term Commitments expire including at any time during which one or more of the conditions in Article IV is not met and shall. A ticking fee accumulates on the portion of.

By contrast term A loans are. We believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10. Commitment fees are typically.

The loan is terminated by the borrower. That is when a loan is modified unamortized fees should continue to be deferred new creditor fees should be capitalized and amortized as part of the effective yield and new fees paid to third parties should be expensed. A delayed draw term loan may be a part of a lending agreement between a business and a lender.

It can also be a component of a syndicated loan which is offered by a group of lenders who collaborate to provide funds to one borrower. Ad Compare 2022s Best Merchant Cash Advance Loans Find the Best Option for Your Business. In connection with the foregoing the Commitment Parties are pleased to advise you of their commitment to provide the Delayed-Draw Term Loan Facility on a several and not joint basis in the amounts set forth opposite each such Commitment Partys name on Annex 1 hereto the DDTL Commitments upon the terms set forth or referred to in this Commitment.

If you take out a DDTL youll be responsible for a ticking fee. Delayed Draw Term Loans February 13 2018 Time to Read. DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of the DDTL commitment.

The ticking fee is due until. Delayed draw term loans are a flexible way for borrowers usually with the backing of sponsors to finance incremental acquisitions after a significant transaction. A commitment fee is a banking term used to describe a fee charged by a lender to a borrower to compensate the lender for its commitment to lend.

That is the fees are paid whether or not the funds are ever drawn down. These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated. Term B loans are usually disbursed in a single advance so the commitment fee is payable on the entire amount of the facility until it is funded.

The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of time the borrower can use the undrawn value of the loan. Define Delayed Draw Term Commitment Fee Rate. With respect to the Delayed Draw Term Commitments 10 per annum for the Delayed Draw Term Commitment Period.

A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to the borrower for a certain period of time.

Financing Fees Deferred Capitalized Amortized

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

Financing Fees Deferred Capitalized Amortized

Financing Fees Deferred Capitalized Amortized

Financing Fees Deferred Capitalized Amortized

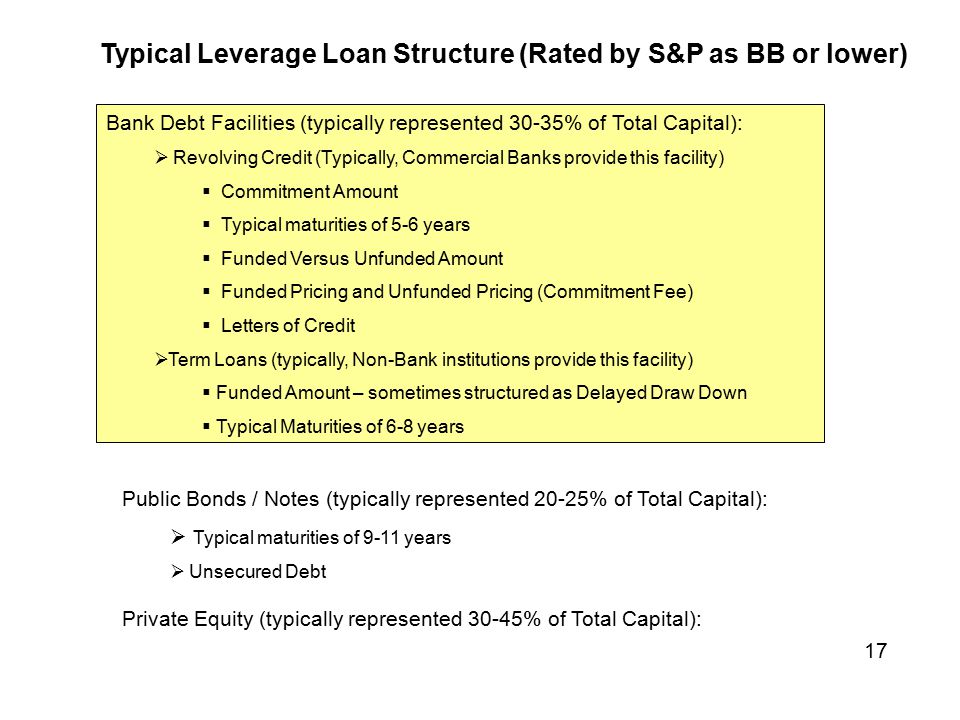

Looking At The Bank Loan Syndication Process Ppt Video Online Download

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Delayed Draw Term Loans Financial Edge

Letter Of Commitment Overview Example And Contents

Houlihan Lokey Advises Cerberus Capital Management Transaction Details

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

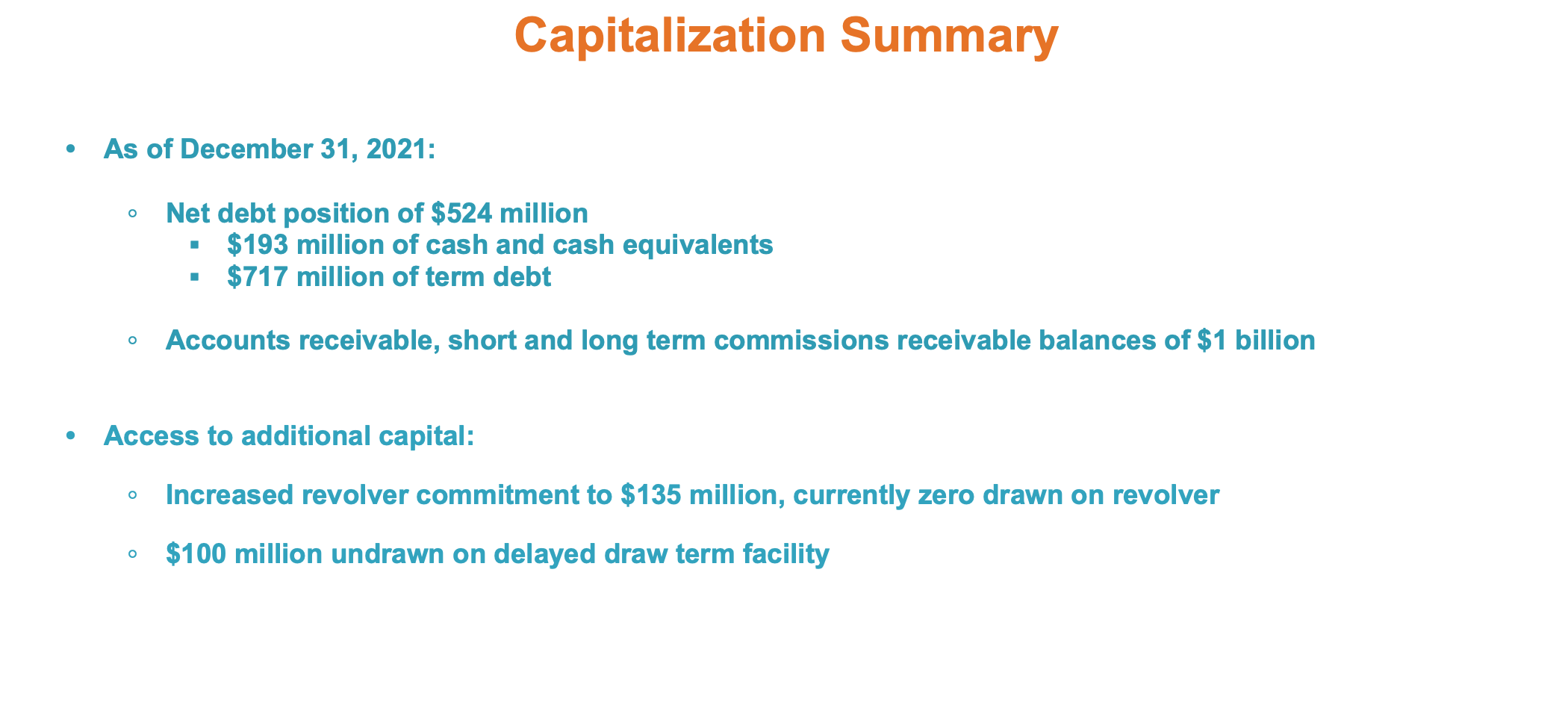

Selectquote Stock This Did Not Turn Out As Planned Nyse Slqt Seeking Alpha